The Risk

You want to make money fast and safe. We all do. Whenever we invest in something, be it digital assets or traditional stock, we are assessing the risk involved in that investment. Fortunately, each individual has a different appetite for risk. According to an HM Treasury paper [1], risk appetite is defined as the amount of risk an organization/individual is prepared to accept, tolerate, or be exposed to at any point in time. The paper showcases five types of risk appetites:

- Averse: Avoids risk at all costs

- Minimalist: Prefers safe options with a low degree of inherent risk and potential for limited reward

- Cautious: Prefers safe options with a low degree of residual risk and which may only have potential for limited reward

- Open: Considers all potential options and chooses the one with the highest success rate and has an acceptable level of reward

- Hungry: Prefers options with greater inherent risk but which could generate higher rewards

Regardless of your risk appetite, you must understand that neither of them is right or wrong. Each can be more or less efficient based on a multitude of factors such as amount invested, the digital asset you are investing in, potential market size, etc.

In an ideal scenario, we want to obtain the maximum amount of return with no risk. That however, is impossible. Risk is, and always will be, part of any investment, be it traditional or digital. Whenever you buy a digital asset, you are also assuming the risk associated with that digital asset, be it risk of fraud, risk of failure, etc.

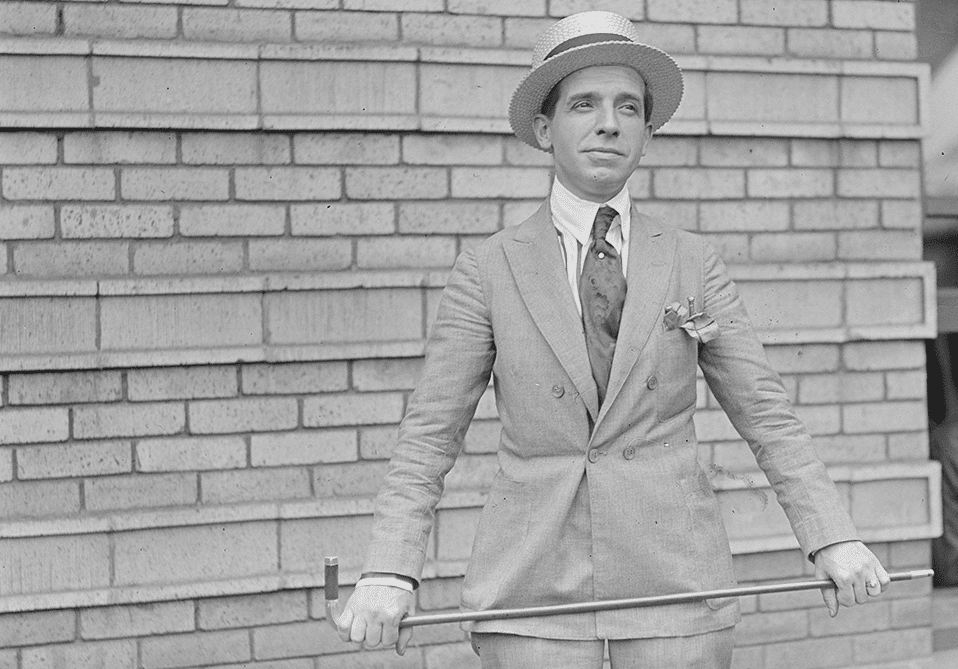

Mr. Charles Ponzi

In the past few months, a number of smart contracts were created on the Tron Network by anonymous individuals, which promise the possibility of high profits with no risk. The most popular of these “projects” promises that you will get 3.33% daily, corresponding to the amount you invested, FOREVER. This means that you would recover your full investment in only 30 days, and from there on it’s pure profit, FOREVER!

Sounds too good to be true? That’s because it is. This type of operation is known for over 100 years and has been made famous by Charles Ponzi [2], a criminal which defrauded money from investors by running the scheme which now has his name. Basically Mr. Ponzi attracted investors and promised them returns of 50% in 45 days or 100 percent in 90 days. He then proceeded to use the money coming from the new investors in his scheme to pay off the older investors. The scheme lasted until August 1920, when The Boston Post began to investigate his returns. The investigation caused panic among the investors, which tried to pull their money out of Ponzi’s scheme. He was then arrested and spent 14 years in prison.

In a Ponzi scheme, a promoter pays back his initial investors with money he has raised from new investors. Eventually, the promoter can no longer find enough new investors to pay off the people who have already put up money, and the scheme collapses – Alex Berenson

However, even after a large number of similar cases were made known worldwide, people still fall prey to these types of scams. The TRX Network contains a number of smart contracts which function exactly like a Ponzi scheme, and have all the red flags[3]:

- Promise of high investment returns with little or no risk: There is no such thing. Even investing in a relatively safe digital asset such as SEED, TRX or XRP carries a decent amount of risk and the returns might not be that high in the short term.

- Overly consistent returns: Markets have cycles and investment values fluctuate over time, especially digital assets which are offering potential high returns. Be suspect of an investment that continues to generate regular, positive returns regardless of the overall market conditions.

- Unlicensed sellers/Anonymous team: Most legitimate projects have a team behind which can be held accountable for any criminal activities. In the crypto world, the majority of scam projects or schemes are run by anonymous individuals.

- Secretive and/or complex strategies: Avoiding investments you do not understand or for which you can’t get complete information is recommended. In the case of the Ponzi schemes on the Tron Network, these are just the foundation for what is yet to come. Expect more complex Ponzi schemes in the future, with a higher degree of complexity.

- Scheme founders defend themselves saying it’s not a scam: If they have no arguments for their project besides this statement, or if they have no other way of generating revenue except from getting new money flowing in the company/project, they are running a Ponzi scheme.

- Difficulty receiving payments/roll over encouragement: Be suspicious if you do not receive a payment or have difficulty cashing out your investment. Keep in mind that Ponzi scheme promoters (the early adopters and founders, in this case), will seek to encourage participants to “roll over” investments and rewards.

Luckily, we are on the blockchain. Information that in any other environment would be problematic/impossible to obtain is easily available to everyone on the Tron Network. All you have to do is some basic research and you can obtain all the information you need to filter legitimate projects from Ponzi schemes and scams.

Ponzi-like Smart Contracts — The Future of Financial Fraud

The oldest project acting as a ponzi scheme on the Tron Network is P3T Daily Roi. The scheme operates as a smart contract on the network, allowing users to deposit TRX and withdraw each minute, up to 3.33% of the “invested” amount each day. The contract started slow, with only a few people depositing TRX, and it took off once the marketing for the Ponzi scheme started. People flooded the website and threw their TRX in the contract, which at it’s peak reached around 37M TRX(approx $870k USD). This was around two weeks ago. People were encouraged by the community and P3T team to “roll over” their rewards to get compound interest. And roll over they did.

The early “investors” which compounded their earnings since the start reached a daily reward amount that could drain the contract in a matter of weeks. And they started cashing out. Once this happened, panic hit the entire P3T community and a chain reaction was initiated. Everyone stopped rolling over their revenue, and started cashing out. The contract value started decreasing, which caused most new investors to stay away from the scheme. Within a week, the contract value decreased to more than half, to around 15M TRX and is currently fully consumed[4]. The P3T community was trying desperately to pursue attracting new “investors” so they can keep cashing out their rewards. Unfortunately for them, P3T was a sinking ship. Even a significant capital infusion of TRX into the contract, would only add a few weeks before the contract would go to 0.

Similar to P3T, other Ponzi-like smart contracts appeared on the Tron Network, each disguised as a new project, with improvements for increased duration, sustainability or reward cycle. For the inexperienced individual, these may seem a safe investment, but in reality they all operate as Ponzi schemes, automated by a smart contract created to defraud people.

The Difference Between Financial Fraud and Investments

You may ask yourself, what is the difference between a Ponzi scheme and a legitimate project? A Ponzi scheme can not survive for long, because it doesn’t generate sustainable revenue. And it doesn’t generate sustainable revenue because it sells no product or service. It doesn’t innovate, it doesn’t produce, it doesn’t bring any added value to anyone else than the creators of the scheme and early participants.

A legitimate project however will do exactly the opposite. It will use resources and create a product or service that people actually need. It will expand organically and generate sustainable revenue. It will have years when it thrives and years when it may even record losses. However that project has all the necessary tools to continue generating sustainable revenue.

Financial fraud is trending! #givemeyourmoney

Other projects on the Tron Network that operate as Ponzi schemes are Bankroll, TronBank, Tron Vault, Turbo ROI, 100roi, Rocket ROI, Trubo Dynamic ROI, Rocket Roi Dynamic, Rising ROI, FOMO 7, 12 ROI, 4Days Profit, and there are more to come. Each of these contracts acting as Ponzi schemes, has its own twist. Some will retain 15% of your initial investment as a fee, others will promise your initial investment back in a few days or a few hours. The only difference between these projects, however, is the number of days they will last before they come crashing down as P3T did.

P3T initiated a get rich quick mania on the Tron Network. Soon after, many more of these ROI smart contracts appeared overnight promising investors to make them rich by assuming no risk. I was checking the P3T Daily ROI contract during the start of their collapse, and saw people depositing hundreds of thousands of TRX, hoping to make a profit. Those people lost most of their TRX now that the contract is fully drained. Simply visiting the P3T Telegram channel will show you the damage this scheme has done to the late “investors”, and the blind faith others have in the so called project.

What Can We Expect In The Future?

Now that we have been through the shrimp farm mania, the gambling mania, and the daily ROI mania (this one is not finished yet), we can expect many other scams and bubbles on the network. I think the next financial fraud project that will become popular in the next few months is the pyramid scheme.

The pyramid scheme is similar to the Ponzi scheme, but there are a number of differences. The pyramid scheme is based on network marketing [5], and each part of the pyramid takes a piece of the income from “sales”, forwarding the money to the top of the pyramid. They fail because there are not enough people to sustain this “business” model. We already have a project on the Tron Network that operates like this, and promises bigger rewards than any SR. And more will come.

The Bottom Line

You should avoid any project that:

- guarantees profits, promises high returns

- claims it can’t fail and assures you, your money is safe

- insists that you should not cash out

- recommends that you should roll-over your returns

- claims it has an overly complex “mechanism” for generating revenue which you can’t possibly understand because you lack the expertise

- has no product or service (finished or in development)

We are in a period where the community prefers to throw its TRX in gambling and fraudulent projects. Due diligence, common sense, and strategy are notions which hold little interest to most individuals. This creates an environment where con artists thrive. Gradually, more financial fraud is generated and at the same time, the amazing technology that is blockchain is discredited.

It is time for the blockchain community to educate each other, call out these frauds for what they are, and focus on the real projects that will bring real life value to the world.

[1] https://webarchive.nationalarchives.gov.uk/20130102234654/http://www.hm-treasury.gov.uk/d/tar_practitioners_guide.pdf [2] https://www.biography.com/people/charles-ponzi-20650909 [3] https://www.sec.gov/fast-answers/answersponzihtm.html#RedFlags [4]https://tronscan.org/#/contract/TKbDT4VAwaMENxQUfTih1TZELGndmzB2vz [5]https://www.scamwatch.gov.au/types-of-scams/jobs-employment/pyramid-schemes

Comments