You may be familiar with exchanges like TronTrade which create bid and ask orders for trading TRC-10 tokens.

But you don’t need a website like TronTrade to trade TRC10 tokens. One of the features of a Tron TRC-10 token is the ability to create a Bancor trading pair exchange right on the blockchain. You can trade these Bancor exchanges directly through the API. You can also use Tronscan to search for and trade them.

What is Bancor?

Bancor is a formula for trading tokens. It works with an account that is loaded with tokens which are referred to as supply, and collateral with a token of accepted value such as TRX.

The TRX on the exchange is considered the base currency of the trading pair. It provides capital, or liquidity, for the exchange.

When you buy and sell a token using Bancor, you are accepting Bancor’s standing offer; the exchange is the counterparty to every trade. When you buy tokens, you add base currency to the account. Conversely, when you sell your tokens base currency is taken away.

How Does Bancor Set the Price of a Token?

A Bancor exchange sets the price of a token by how much base currency is held as collateral on the exchange compared to how much token supply there is. Bancor calculates the price of the token by dividing the amount of collateral by the amount of tokens. Buying raises the price because it changes the ratio of tokens to collateral on the exchange.

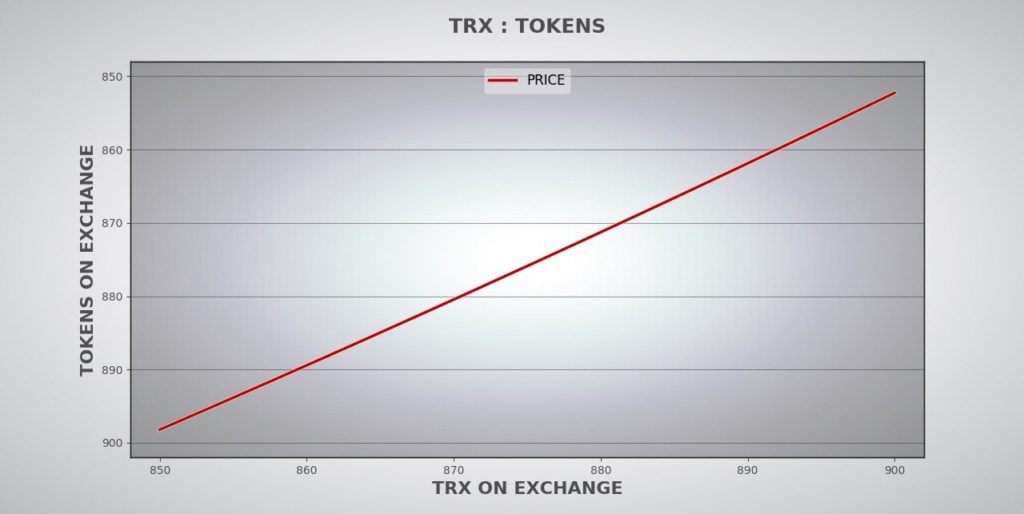

When exchanges have roughly equal amounts of supply and collateral the price increases at a steady rate.

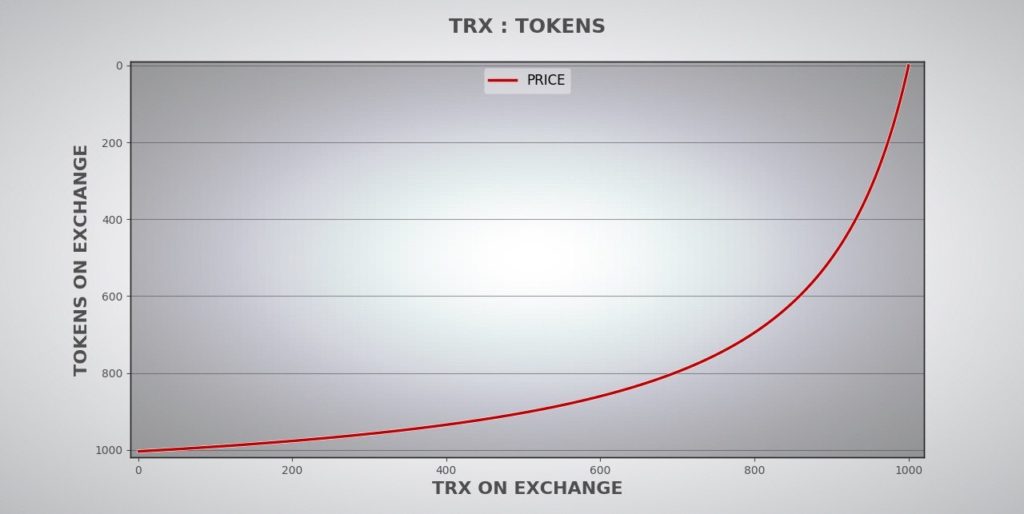

When there is a large disparity between the ratio of supply to collateral, the price changes faster and each new buyer moves the price by an increasingly large increment.

Let’s say an exchange creator put 1000 ABC tokens and 100 TRX on the exchange. The price of ABC token is 0.1 TRX.

John Q Public buys 100 ABC tokens for the expected price of 10 TRX.

But how much would he really get?

If the exchange ends up with 900 ABC and 110 TRX, his purchase would have changed the price from 0.1 to 0.122 which should get factored into the price he pays. John’s average price will be a lot higher than 0.1 and the final price of ABC will be higher than 0.122.

As we’ve seen, whenever a token is bought or sold it changes the price on the exchange. Bancor calculates the cost of a large trade using a gradually changing price. If you were to purchase tokens with a hundred small trades the price could end up moving quite a bit but you might not notice the small increments.

The way Bancor works is that if you bought those tokens all at once your average price would be the same as if you bought them in 100 small trades, and the difference between the expected amount and the actual amount is more noticeable.

This can be confusing and frustrating for the Bancor trader, and therefore makes it very important for you to know how big an exchange is.

Bancor’s Most Misunderstood Concept

The most misunderstood concept with Bancor markets is the ability to inject or withdraw capital. In addition to buying and selling, the exchange creator can inject or withdraw supply and liquidity on the exchange without changing the price, essentially “making the pie higher.”

Here’s how an injection works. Let’s say the ABC exchange started with 1000 tokens and 100 TRX but then the exchange manager injected an additional 9000 tokens and 900 TRX. He hasn’t changed the price at all, just the size of the pool. Now when John Q Public buys 100 ABC tokens his expected cost would only change the price to 0.1020 and his actual price will be much closer to what he expected.

The Takeaway

Two tokens with the same price can trade very differently if one of the exchanges is 10x larger.

An exchange that injects capital can in fact increase how much the token is worth by decreasing its volatility. This has value to investors and traders.

Comments